In this blog post, we will examine SEBI’s FII data. Let’s start with making sense of the columns in the data and how they are related (the data column names will be italicized alongside). FIIs are investment institutes who register purchases/sells for foreign investors. These are executed by brokers registered with the SEBI. There are about a dozen transaction types such as purchase in the primary market, sale in the secondary market, etc. The scrips are the shares of companies being bought or sold.

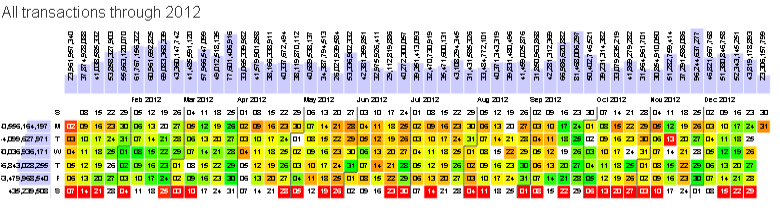

We plotted the total transactional value for each day in 2012 and this is what we have:

Some things we observed are:

- Thursdays have the highest volume of transactions, followed by Friday. As we all already knew, Mondays are about the blues.

- The white cells signal days of no business. Sundays have no transactions taking place at all; Saturdays are also very poor at that.

- Certain months are riddled with green cells. Most of February-March seem to have the highest frequency of transactions. Followed by September and December.

- All the highest peaks, seem to have come from the last weeks of quarter ends. That of March and September could be explained knowing that these are quarter endings, but what about November then?

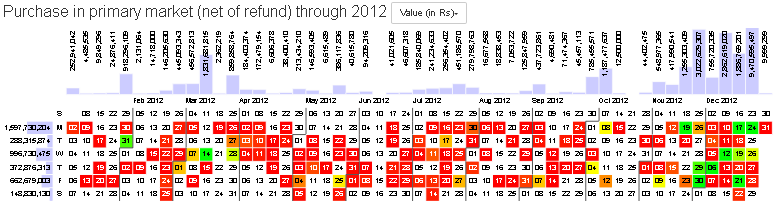

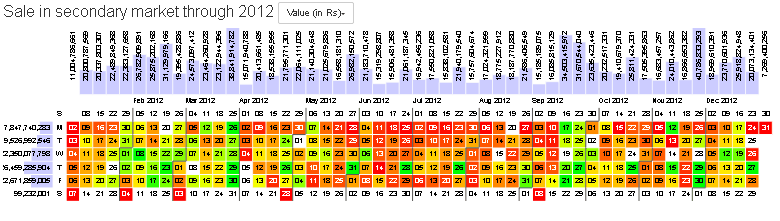

Let’s take a break with some food-for-thought. If these are the patterns we see in all transactions, what do you observe in the following purchase and sell transactions? The transaction names can be seen in the top-left corner of the visuals:

The data is in a fairly easy format for anyone to play around with. Feel free to explore!