Churn analysis uses insights to help B2B and B2C organizations identify the reasons for customer attrition. Let’s explore churn analysis with simple examples.

Ben is dissatisfied with frequent call connectivity issues on the LoSignal network and decides to terminate his contract with them and switch over to their main competitor.

AcmeCorp decides that the customer experience offered by Manageo’s Project Management tool is not worth what they’re paying for, and decides to cancel their subscription.

These are the examples of customer churn and how companies lose clients/customers.

Table of Contents

Customer Churn Rate is the percentage of customers who stopped using a product or service during a particular time frame.

The first case talks about a B2C situation, where Ben is one of the hundreds of thousands of LoSignal’s customers. In LoSignal’s case, the revenue per customer is comparatively lower, as is the cost of acquiring new customers.

In the second B2B case with Manageo, the customer experience plays a more crucial role in preventing AcmeCorp from leaving, because the number of customers is significantly lower, and the cost of acquiring new customers is higher. The revenue generated by every customer like AcmeCorp is also high.

Did you notice?

In the above cases, Ben and AcmeCorp have “churned”.

In today’s growing marketplace, customer attrition is commonplace. Consumers have a wide variety of options to choose from, each one offering something different — a better customer experience, lower pricing, or better products and services. So, it’s vital for organizations to perform customer churn analysis to retain their customers, be it a B2C or a B2B scenario.

What is Customer Churn Analysis?

Churn analysis helps in determining the trend of customer attrition. The impact of churn analytics efforts are visible in improved customer retention rate.

The right churn analysis insights will help you understand 3 key points through the analytics toolkit:

- Why are customers churning? What are the key customer dissatisfaction drivers? You can tackle this with descriptive and diagnostic analytics.

- How do you identify which customers are going to churn in the coming months? You can answer this with predictive analytics.

- What should you do to minimize churn? Prescriptive analytics holds the key to this.

Before getting into the analytics part, we need to first understand churn rate.

You can calculate the customer churn rate by factoring in the number of customers who left during a particular time period and the total number of customers at the start of that time period. Here’s the formula for more clarity:

Next, the goal of customer churn analytics is to determine why did a customer stop using a product or cancel a subscription. This usually involves tracking the customer journey and finding out what actions the customer took just before they quit.

For instance, did they get stuck performing a certain task? Did they encounter any bugs in the system while submitting a page? Feedback calls, follow-up surveys and questionnaires can also help in identifying reasons for customer churn.

Customer churn analysis also tries to predict which customers are likely to quit. For instance, a lower number of login sessions indicates low usage, and a high possibility of customers churning. After all, why would they pay for something they don’t use often?

By answering these questions, you can improve your customer experience and retain more clients.

Why is Churn Analysis Important?

The most important factor is that Churn Analytics Results in increasing your profits. Fred Reichheld, the founder of the NPS score system, found that if you retain just 5% of your customers, it results in at least 25% higher profits in the long run. On the other hand, churned customers don’t contribute anything to your revenue.

Check out Gramener’s NPS Analytics solutions, which aim to help you improve the Net Promoter Score of your brand by analyzing customer behavior and sentiments from multiple customer feedback and review sources. Check out our guide on how to calculate NPS with Machine Learning.

Second, retaining customers also means that you will unlock the long-term benefits of customer loyalty. A Bain & Company study found that customers who bought from a particular e-commerce platform for about 3 years, spent about 67% more than customers who had been buying from the platform for about 6 months.

Third, churn analysis reduces costs. Depending on your industry, acquiring new customers is five to 25 times more expensive than retaining an existing one.

It costs more for businesses to acquire new customers than retain existing ones, because existing customers have already bought into your products or services, the philosophy of your company, and are more familiar with your offerings.

In fact, customers who have been your customers for quite some time will do the best they can to not churn, because new offerings will mean an unfamiliar way of doing things.

How Does Churn Analytics Work?

Simply calculating the churn rate is not sufficient to help you decrease it. You need the following data points as well.

| Data Points You Need for Churn Analysis |

|---|

| 1. Why does customer churn happen? |

| 2. Which Customers are Canceling? |

| 3. How Can You Predict Customer Churn? |

Churn analytics can help you answer the above questions and more. Let’s tackle the “why” question first.

Why Does Customer Churn Happen?

To answer this, you need to first capture the user behavior before they dropped off and see at which stage they decided to churn. Once you’ve captured the data, you will get a few initial insights.

Here are a few possible scenarios for customer churn in B2B:

- The overall customer experience is lacking

- Customers don’t get the value they expected from your product

- You don’t have a robust onboarding process that helps users start using the offering

- Your product is too expensive compared to competitors.

- UI/UX is not intuitive and fluid

- Bugs and glitches

- Slow load time or processing time

Against each reason, you can start assigning $ values.

For instance, let’s say you’ve found out that 20 of your churned customers, each of whom subscribed to your offering for $100 a month, quit due to poor customer experience. This means that you have lost revenue of 20X$100 = $2000 a month due to delivering a subpar customer experience.

Once you have determined the reasons for your biggest revenue losses, you can prioritize and work on them.

Which Customers are Canceling?

As you get more data about the customers who cancel, you can classify them into different buckets based on their demographics, behavior, and the offerings they are using.

Customer churn is one of the biggest problems of the streaming services industry in the U.S., with 41% of customers churning as of Q1 of 2020 (largely exacerbated by users staying home and wanting to try new services during the Covid-19 lockdowns).

So you can bucket churned customers based on common characteristics such as:

- Whether they signed up for a trial

- The plan they chose

- The number of devices they chose

- Users who experienced a particular update or new feature

This grouping and analysis of customers is called “Cohort Analysis” and it lets you zero in on the common factors that led to customer attrition.

For instance, a large number of customers who signed up for a particular plan may cancel. Delving into the details, you may find that a competitor has a similar offering at a lower cost. Or a group of customers didn’t convert after the trial because they didn’t find enough value to pay for a subscription.

You can take targeted action to retain each of your cohorts. While a group of customers responds well to discounts, other customers will stick with you even without them.Some customers love loyalty programs, while for some others, it doesn’t make a significant difference. This clustering of customers helps you understand how you can improve your customer experience.

How Can You Predict Customer Churn?

Once you have a sufficiently large dataset of your churned customers, you will begin to understand which customers are churning, and why. Based on this, you will be in a position to predict which customers will churn next.

How can you achieve this? You can train a Churn Analysis Machine Learning model based on the data that will predict which customers are likely to churn.

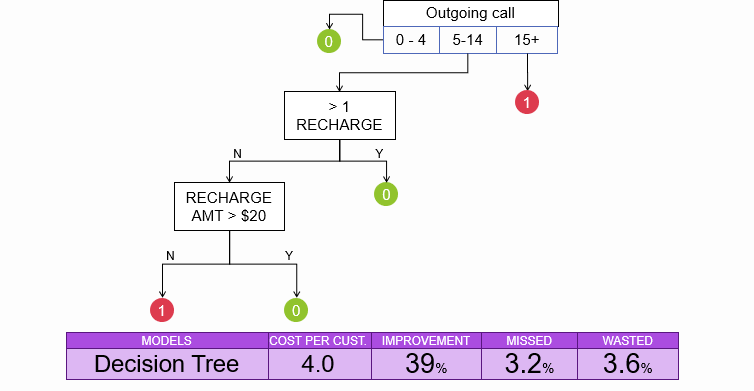

There are several algorithms like decision trees, random forests, and logistic regression that can be deployed based on your industry, offerings, and other factors.

Each will give a different accuracy rate. Based on these algorithms, a robust AI model is tailored for our organization.

Let’s look at a real-time case study based on a set of algorithms that we applied for one of our clients, a leading telecommunications provider in the U.S.

Case Study: Churn Analysis for a Leading Telecom Client

Customer churn in the telecom industry is very common due to huge competition.

Did You Know!

The U.S. telecom industry witnesses an annual churn rate of 30-35%. This means that for every 100 people who start the year as customers, 30-35 opt out by the end of the year.

One of the measures that companies use to predict who will churn, target the right customers and deploy interventions to prevent this.

The Challenge

Gramener worked with a major telecom operator to identify customers who are likely to churn so that the firm could target its marketing efforts in the right direction.

The Approach

Gramener applied a series of classification models based on customer behavior, demographics, and network behavior. The result was a series of churn prediction models of increasing accuracy.

The Outcome and Impact

Through derived variables and hybrid models, Gramener identified savings of over 60% on acquisition cost through targeted marketing. The process of identifying targets was also fully automated by the model.

Reduce Customer Churn with Gramener

Customer churn analytics is a great way to find out which customers are canceling, why they are canceling, and who will cancel next. Taking the analytics route will also let you reap the maximum ROI from customer experience (CX) efforts.

It helps you segment them and target marketing campaigns according to their demographics and behavior. It’s vital to provide excellent customer service if you want to keep your current customers. If customer service is inadequate, it does not take long for customers to migrate to another service provider. When your customers rate your services, you’ll be able to see how satisfied or dissatisfied they are. The customer sentiment analysis technique is used to reduce customer attrition.

The entire process helps you retain more customers, build a brand, and get you more repeat customers and referrals which will help you uncover your customers’ pain points and give you an opportunity to address them. This in turn will lead to an improved customer experience.

Are you interested in knowing more about how you can reduce customer churn? Talk to us today.

Could you please provide more details about the features. what type of data pre processing, feature engineering, modelling were done at a high level.